Bydly Insights

Explore the latest news, trends, and insights across various topics.

When Crypto Gets Dizzy: Navigating the Rollercoaster of Market Volatility

Strap in for the wild ride of crypto! Discover tips to navigate market turbulence and stay ahead in the dizzying world of digital currency.

Understanding Market Volatility: Why Crypto Prices Fluctuate

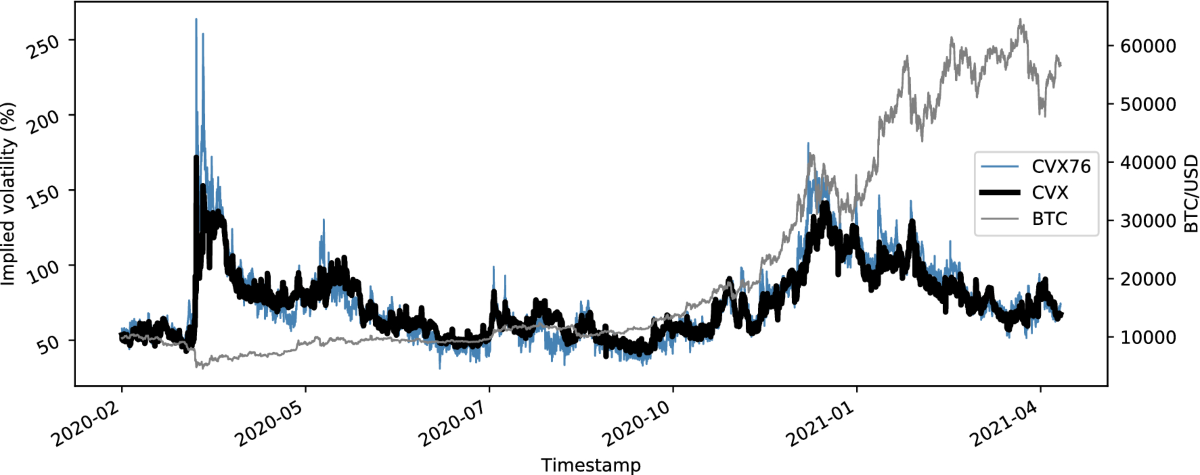

Understanding market volatility is crucial for anyone involved in the cryptocurrency space. Unlike traditional financial markets, the cryptocurrency market is relatively young and lacks the stability provided by established regulations and institutional frameworks. This instability can lead to significant price fluctuations, driven by various factors such as investor sentiment, speculation, and market demand. For instance, when positive news emerges—like regulatory acceptance or technological advancements—investors may flock to buy, causing prices to surge. Conversely, negative news or events, such as hacks or regulatory crackdowns, can trigger a rapid sell-off, leading to steep declines in prices.

Moreover, market volatility in cryptocurrencies is exacerbated by the limited liquidity compared to traditional markets. Since the number of active traders and the volume of transactions can be relatively low, even small trades can significantly impact prices. In addition, social media and online forums can amplify this effect, as rumors and trends spread quickly, influencing investor behavior. As a result, it's essential for crypto investors to understand the underlying factors behind price fluctuations, as well as to adopt strategies that mitigate the risks associated with such volatility.

Counter-Strike is a highly popular multiplayer first-person shooter that has captivated gamers since its release. The game emphasizes teamwork and strategy, where players can engage in various game modes. For those interested in gaming-related promotions, you can check out the cloudbet promo code to enhance your gaming experience.

Top Strategies for Surviving Cryptocurrency Market Dips

Cryptocurrency market dips can be unsettling for even the most seasoned investors. One of the top strategies for surviving these downturns is to adopt a long-term investment perspective. Instead of reacting impulsively to short-term fluctuations, consider holding onto your assets during dips. Historically, cryptocurrencies have demonstrated resilience and the capacity for recovery. By staying informed about market trends and focusing on projects with solid fundamentals, investors can navigate these turbulent times more effectively.

Another effective strategy is implementing a dollar-cost averaging approach. This involves regularly investing a fixed amount of money into your chosen cryptocurrencies, regardless of their current price. Consequently, this method reduces the impact of volatility on your investment overall. As markets dip, you purchase more coins at lower prices, thus averaging your purchase cost over time. Additionally, setting stop-loss orders can help mitigate potential losses by automatically selling your holdings when they reach a predetermined price.

Is It Time to Panic? Recognizing the Signs of a Market Correction in Crypto

The cryptocurrency market has always been known for its volatility, making it essential for investors to stay alert and recognize the signs of a potential market correction. One of the first indicators is a significant decline in trading volumes, which often precedes falling prices. When you notice trading volumes diminishing, it may be time to assess the overall market sentiment and the influence of external factors such as regulatory news or macroeconomic changes. Moreover, if established cryptocurrencies, such as Bitcoin or Ethereum, begin to exhibit prolonged downtrends, it can be a signal for investors to take precautionary measures.

Another critical signal of a market correction is the occurrence of sharp price fluctuations in a short period. If the price of your favorite altcoin drops by more than 10% to 20% within a week, it’s crucial to consider what’s driving the market dynamics. Additionally, keep an eye on social media sentiment and community discussions, as a shift in investor confidence could be a harbinger of broader market movements. Assessing both technical indicators and fundamental developments can provide a clearer picture of whether it truly is time to panic or if it's just a typical ebb and flow in the crypto market.