Bydly Insights

Explore the latest news, trends, and insights across various topics.

Game On: Decoding the Crypto Currency Behind Tokenomics

Unlock the secrets of tokenomics and discover how cryptocurrency is reshaping the gaming world. Dive in and level up your knowledge!

Understanding Tokenomics: The Key to Successful Crypto Projects

Tokenomics refers to the economic model behind a cryptocurrency or blockchain project, encompassing the distribution, supply, and demand dynamics of its native tokens. Understanding tokenomics is crucial for investors and developers alike, as it directly influences the long-term viability and success of a project. Key elements include token supply, which can be fixed or inflationary, and distribution methods like airdrops or mining. Evaluating these factors helps in assessing the value proposition of a crypto project and is essential for making informed investment choices.

Additionally, a well-structured tokenomics model can promote community engagement and drive adoption. For instance, incentives such as staking rewards and governance rights allow token holders to actively participate in the project's development. Understanding how different tokens interact within the ecosystem can highlight potential risks and opportunities. In summary, mastering tokenomics is an indispensable aspect of navigating the complex world of cryptocurrencies and identifying projects that are poised for success.

Counter-Strike is a highly popular tactical first-person shooter game where teams compete to complete objectives, such as planting or defusing bombs. Players use a variety of weapons and tactics to outsmart their opponents, making strategy and communication key components of the gameplay. For those looking for bonuses while gaming, you can check the bc.game promo code for some exciting offers.

How Cryptocurrency Tokenomics Influences Market Dynamics

Cryptocurrency tokenomics plays a pivotal role in shaping market dynamics by influencing investor sentiment and adoption rates. Tokenomics encompasses the economic model of a cryptocurrency, detailing aspects such as the total supply of tokens, distribution methods, and incentives designed for token holders. For instance, a well-structured tokenomics model that incorporates deflationary mechanisms, such as token burns or buybacks, can create scarcity and drive up demand, thereby positively impacting the token's value. Furthermore, clear communication regarding how tokens will be utilized within the ecosystem, whether for transactions, governance, or staked rewards, helps build trust among potential investors and fosters a stable market environment.

Moreover, the scaling of tokenomics strategies can significantly influence liquidity and overall market performance. A cryptocurrency that integrates liquidity pools and incentivizes users to engage in trading may enhance the trading volume of its tokens, creating a robust market presence. Additionally, the dynamics of staking and yield farming can serve to retain tokens within a community, reducing sell pressure and enhancing price stability. As the market matures, the effectiveness of these tokenomic strategies will determine not only the longevity of the project but also its resilience in the face of market fluctuations, ultimately establishing a relationship between tokenomics and market sentiment.

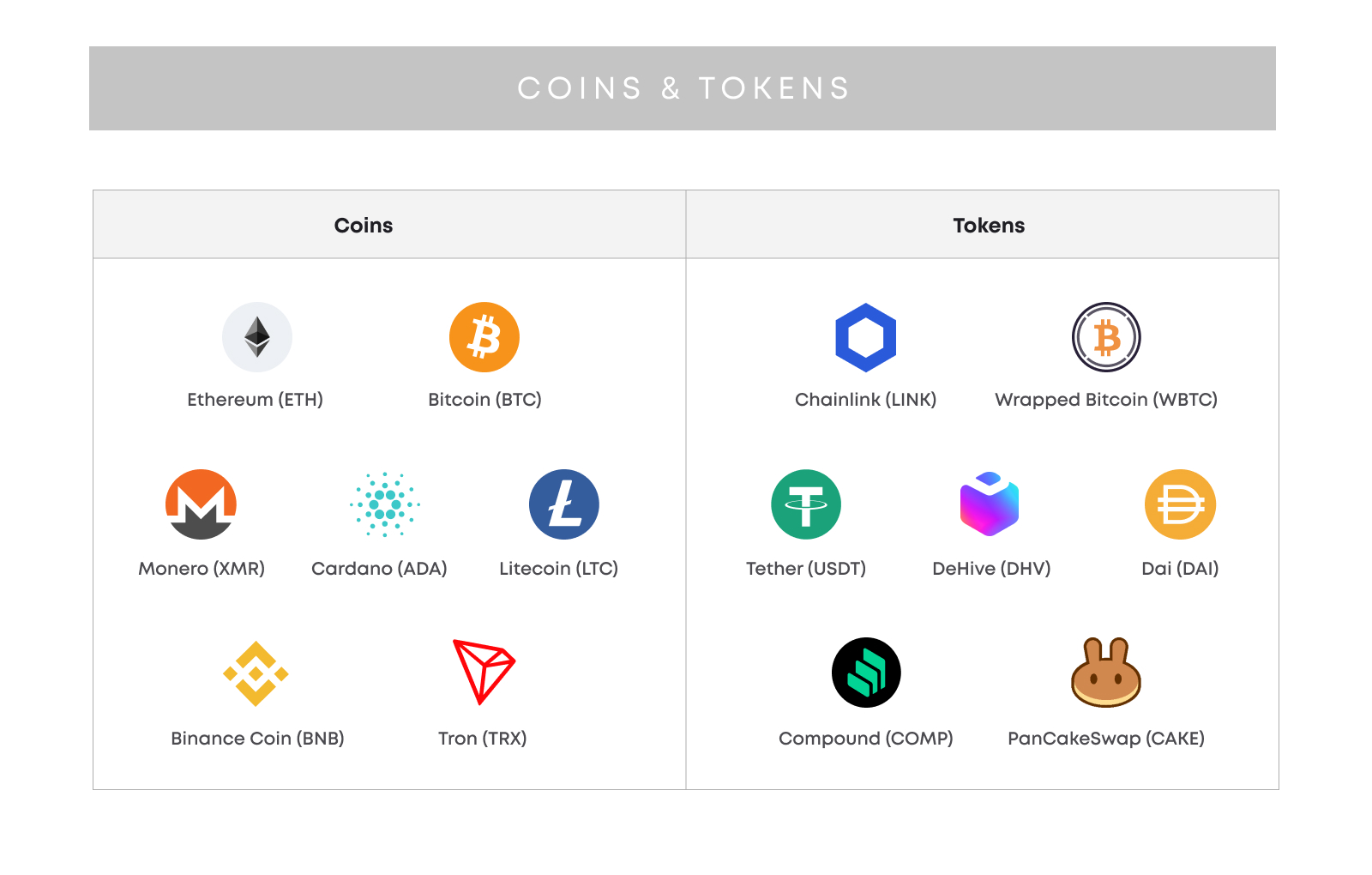

What Are Tokens and How Do They Work in Crypto Economies?

Tokens are digital assets created on a blockchain that represent a unit of value. In the realm of crypto economies, tokens serve multiple purposes, including facilitating transactions, granting access to services, and representing ownership of assets. Unlike cryptocurrencies, which primarily function as a medium of exchange (like Bitcoin), tokens can embody a wider array of functions and can be classified into different categories such as utility tokens, security tokens, and non-fungible tokens (NFTs). Each type serves distinct purposes and is governed by its unique set of rules and regulations.

In crypto economies, tokens operate within decentralized networks, enabling peer-to-peer transactions without intermediaries. Utilizing smart contract technology, tokens can execute predefined actions automatically based on conditions specified in the code. This programmability allows for complex functions such as decentralized finance (DeFi) applications and governance systems in which token holders can vote on proposals. As blockchain technology continues to mature, understanding how tokens work will be crucial for participants looking to engage effectively in these innovative digital economies.