Bydly Insights

Explore the latest news, trends, and insights across various topics.

Whole Life Insurance: The Policy That Keeps on Giving

Unlock financial security with whole life insurance! Discover why this policy is your lifelong asset waiting to support you.

The Benefits of Whole Life Insurance: Why It’s Worth Considering

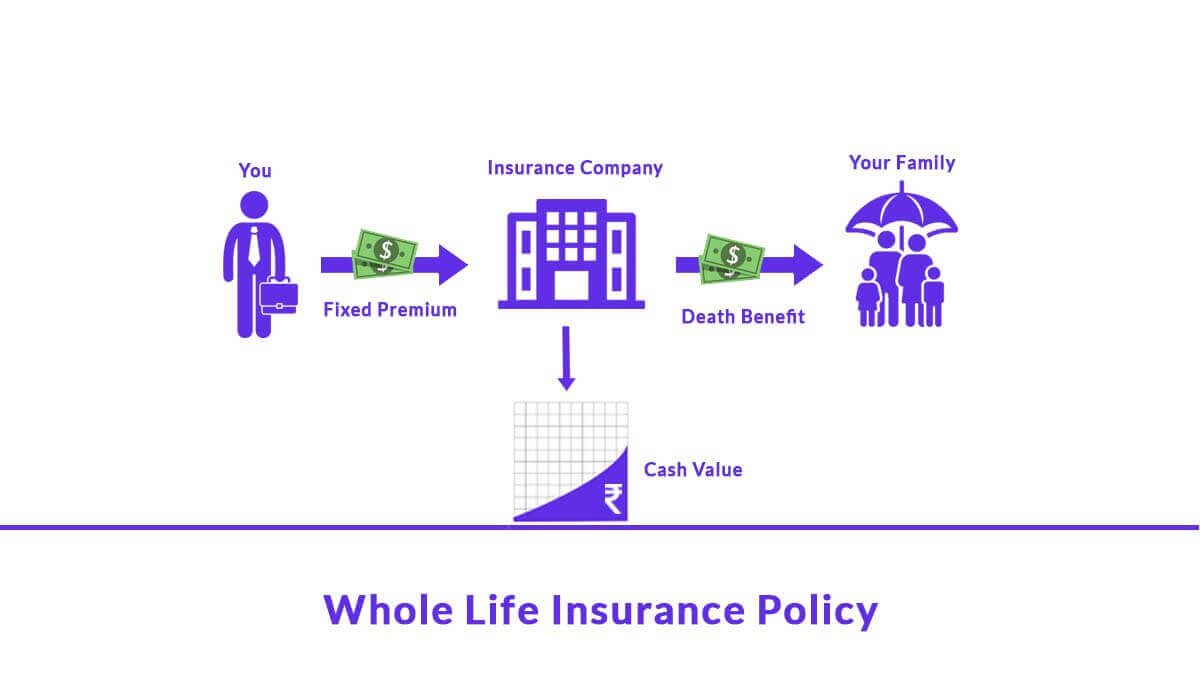

Whole life insurance offers a unique blend of lifelong coverage and a cash value component, making it a valuable financial tool. Unlike term life insurance, which expires after a set period, whole life insurance guarantees coverage for your entire life as long as premiums are paid. Additionally, it can serve as a forced savings mechanism since a portion of your premium goes towards building cash value over time. This accumulated cash value can be borrowed against or withdrawn, providing policyholders with flexibility and financial security in times of need.

One of the most significant benefits of whole life insurance is the potential for steady, predictable growth of the cash value. The cash value grows at a guaranteed rate, which means you can count on it as a reliable part of your financial portfolio. Moreover, the death benefit is paid out tax-free to beneficiaries, providing peace of mind that your loved ones will be financially supported after you're gone. With its dual benefits of coverage and cash accumulation, whole life insurance is worth considering for anyone looking to enhance their long-term financial strategy.

Whole Life Insurance Explained: How It Works and What It Covers

Whole Life Insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. Unlike term life insurance, which only covers a set period, whole life insurance combines a death benefit with a cash value component that grows over time. This means that not only does your family receive a payout upon your passing, but the policy also accumulates savings, which can be accessed during your lifetime. The cash value grows at a guaranteed rate, making it a reliable financial tool that can supplement retirement income or be borrowed against in times of need.

One of the key features of whole life insurance is its ability to provide stability and predictability in an unpredictable world. Premiums are typically fixed and do not increase as you age, making budgeting manageable. Additionally, whole life insurance often pays dividends, depending on the issuing company's financial performance, which can be reinvested to increase the cash value or paid out to the policyholder. Overall, whole life insurance offers both protection and a means to build wealth, making it a versatile option for those looking to secure their financial future.

Is Whole Life Insurance Right for You? Key Considerations and FAQs

Deciding whether whole life insurance is right for you involves considering several factors. Whole life insurance provides lifelong coverage and includes a cash value component that grows over time. This can be appealing for individuals seeking a savings element alongside their insurance policy. However, it typically comes with higher premiums compared to term life insurance. Before committing, assess your financial goals, budget, and the needs of your beneficiaries. For example, if you're looking for a way to provide financial security for your family while also building a cash reserve, whole life insurance might be suitable.

Here are some key considerations and frequently asked questions regarding whole life insurance:

- What are the primary benefits? Whole life insurance offers guaranteed death benefits and stable cash value growth.

- How does it compare to term insurance? While whole life insurance provides lifelong coverage, term insurance is typically more affordable but only covers you for a specified period.

- Is it a good investment? The cash value accumulates slowly, making it less ideal as a primary investment vehicle compared to stocks or mutual funds.

Understanding these aspects can help you make an informed decision about whether whole life insurance aligns with your financial strategy.